additional net investment income tax 2021

Youll owe the 38 tax. The net investment income tax or NIIT is an IRS tax related to the net investment income of certain individuals estates and trusts.

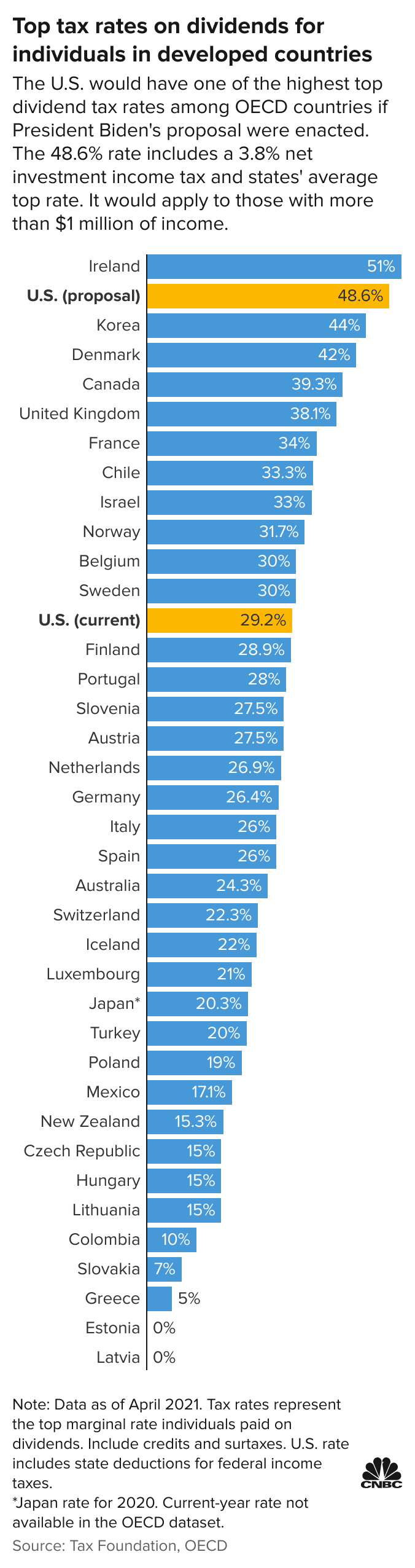

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The 38 Tax You May Need to Worry About.

. For the 2021 tax year single filers have their deductions set at 12550 a 150 increase from 2020. Also when people in the higher earning bracket calculate their net investment income tax of 38 it is essential to deduct investment interest. Modified adjusted gross income over a certain.

According to an April 28 2021 Congressional Research Service Report the Joint Committee on Taxation estimates that the net investment income tax will raise approximately 275 billion of revenue in 2021 and that the majority of the tax is paid by higher-income households see Congressional Research Service The 38 Net Investment Income Tax. If you profit from your investments this ones for you. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income Medicare contribution tax more commonly referred to as the net investment income tax NIIT.

All About the Net Investment Income Tax. What is the Net Investment Income Tax Rate. The net investment income tax NIIT is a 38 tax on investment income such as capital gains dividends and rental property income.

The second tax faced by high-income taxpayersthe net investment income tax NIITis a 38 percent tax on qualifying investment income such as interest dividends capital gains rents royalties and passive income from businesses not subject to the corporate income tax. And depending on how much money you make annually you may also be responsible for net investment income tax. The tax is calculated by multiplying the 38 tax rate by the lower of the following two amounts.

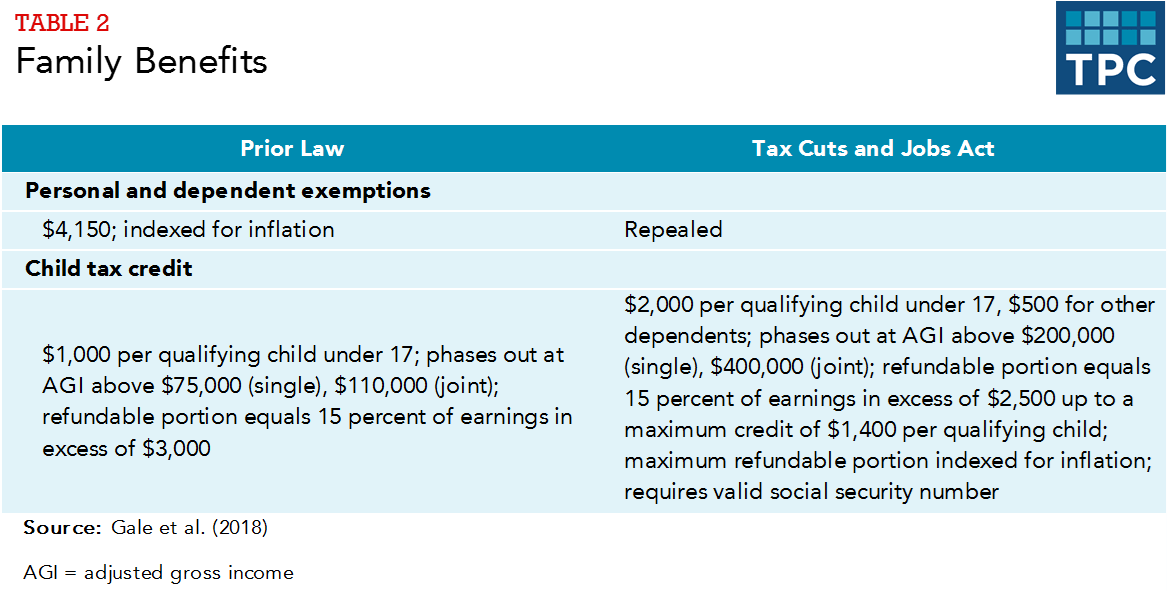

Married couples filing jointly have it at 25100 300 increase from 2020. The child tax credit for 2021 is 3600 for each child under age 6 and 3000 for each child ages 6 to 17. 2019 Tax Bracket for Estate.

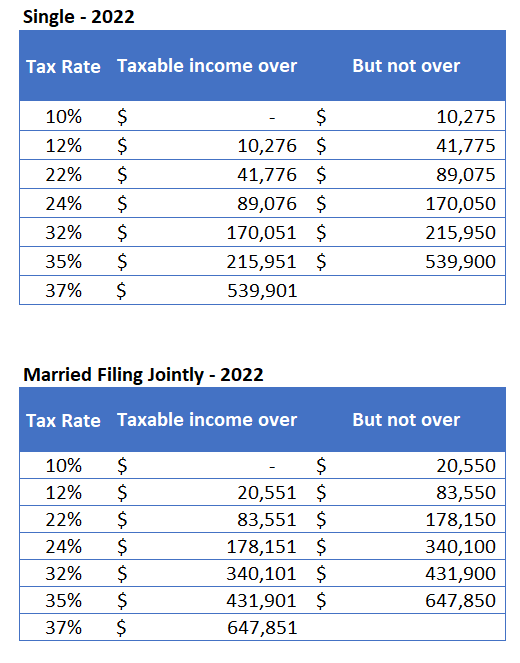

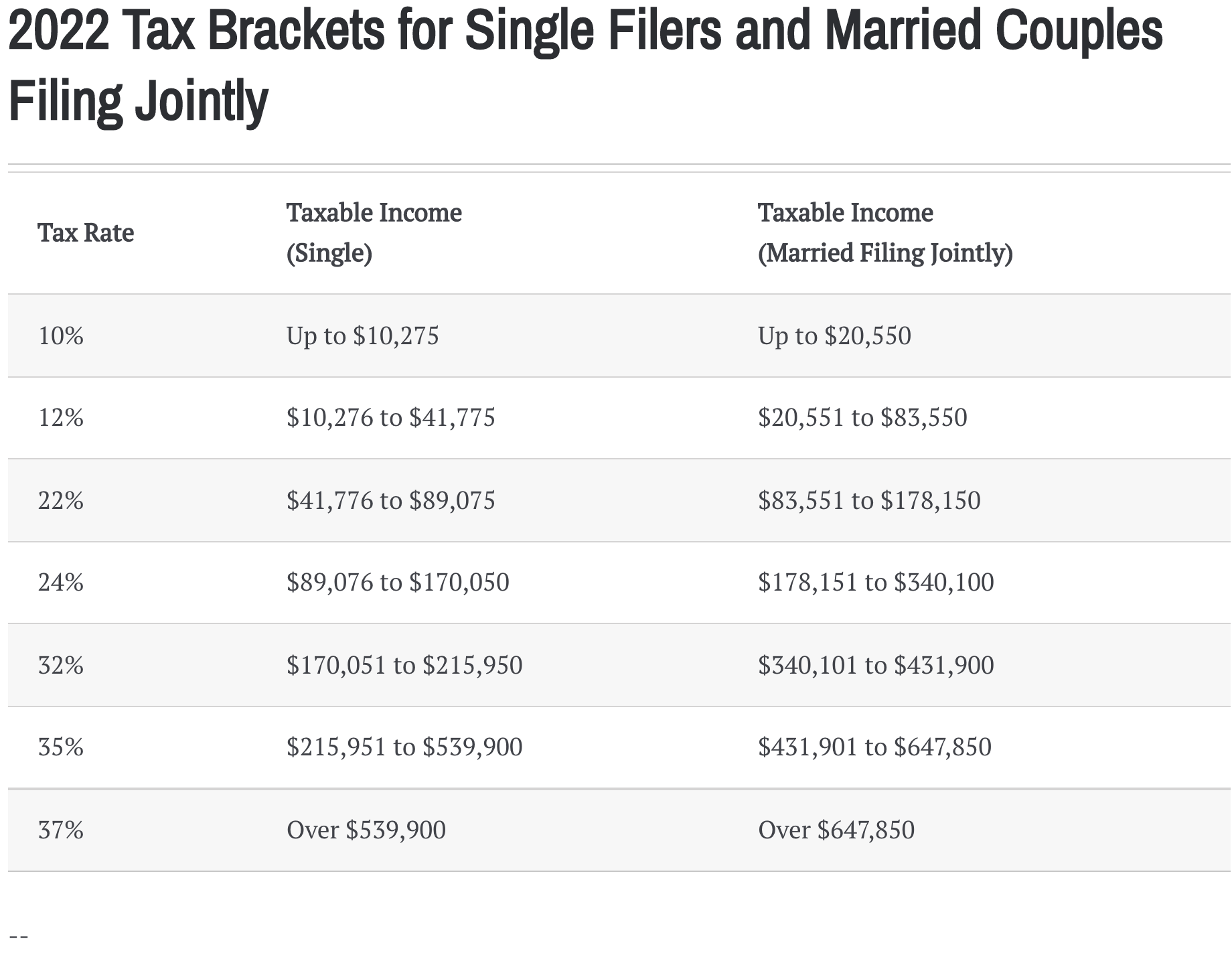

2021 Federal Income Tax Brackets. Assume his net earnings from self-employment are US208700. To see what rate youll pay see What Are the Income Tax Brackets for 2021 vs.

20 with AGI up to 43000 in 2021 and 44000 in 2022. Income generated by certain types of businessesspecifically limited partnerships. A the undistributed net investment income or.

Those rates currently range from 10 to 37 depending on your taxable income. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000.

Youre responsible for paying capital gains tax. Heads of households can claim a credit for up to 2000 of contributions at a rate. Net Investment Income Tax NIIT is a 38 same tax rate tax year 2021 2020 of Medicare tax that applies to investment income and to regular income over a certain threshold.

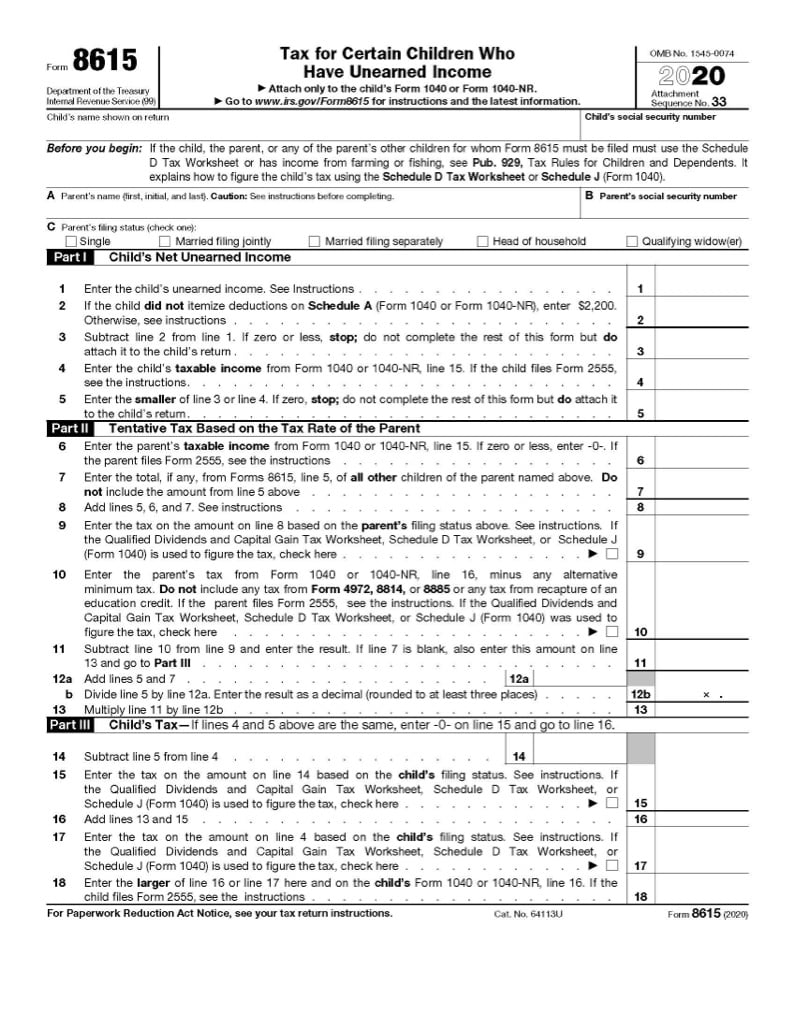

7 - Salary deferrals 401k 403b etc can reduce MAGI for the 38 surtax but cannot reduce earned income for the 09. You wont know for sure until you fill out Form 8960 to calculate your total net investment income. For more information on the Net Investment Income Tax refer to Tax filing FAQ.

However if the taxpayer is also subject to the net investment income tax there is an additional 38 tax imposed on those same capital. B the excess if any. April 28 2021 The 38 Net Investment Income Tax.

The second tax faced by high-income taxpayersthe Net Investment Income Tax NIITis a 38 percent tax on qualifying investment income such as interest dividends capital gains rents royalties and passive income from businesses not subject to. The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax year. The full credit can be claimed by married joint filers with modified adjusted gross income MAGI of up to 150000 single filers with MAGI of up to 75000 and heads of household with MAGI of up to 112500.

It only applies to incomes. But youll only owe it on the 30000 of investment income you havesince its less than your MAGI overage. Rachel Blakely-Gray Jul 15 2021.

That means you could pay up to 37 income tax depending on your federal income tax bracket. Your additional tax would be 1140 038 x 30000. If you earn income from any of your investments this year you may have to pay the net investment income tax in addition to the regular income taxes you owe.

Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. Your net investment income is less than your MAGI overage. But not everyone who makes income from their investments is impacted.

A married couple with a net investment income of 240000 and modified adjusted gross income of 350000 will pay 38 on the lesser amount of the 240000 of net investment income or 350000 250000 100000 of modified adjusted gross income yielding an NIIT of 100000 3 8 3800. Your net investment income is less than your MAGI overage. Net investment income for the year.

In general net investment income for purpose of this tax includes but isnt limited to. If your Modified Adjusted Gross Income exceeds 200000 or 250000 if youre married and filing jointly you may be subject to the NIIT. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax.

The statutory authority for the tax is. 10 with AGI up to 66000 in 2021 and 68000 in 2022. Surtax on Net Investment Income.

When you trigger the high-income threshold for the Medicare surtax then you could pay 38 29 Medicare plus 09 surtax on some portions of your income. Given the complexity of the 38 tax if this tax is applicable for you based on the guidelines above we encourage. In the US short-term capital gains are taxed as ordinary income.

However in determining his self-employment tax T cannot use the FEIE amount to reduce his self-employment income. More specifically this applies to the lesser of your net investment income or the amount by which your modified adjusted gross income MAGI surpasses the filing status-based thresholds the IRS. This tax only applies to high-income taxpayers such as single filers who make more than 200000 and married couples who make more than 250000 as well as certain estates and trusts.

Updated for Tax Year 2021 January 21 2022 0505 PM. For estates and trusts the 2021 threshold is 13050 Definition of Net Investment Income and Modified Adjusted Gross Income.

Form 8615 Tax For Certain Children With Unearned Income

Easy Net Investment Income Tax Calculator

What Is The The Net Investment Income Tax Niit Forbes Advisor

Sources Of Personal Income In The United States Tax Foundation

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

What You Need To Know About Capital Gains Tax

What Is Investment Income Definition Types And Tax Treatments

Income Tax Brackets For 2022 Are Set

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Dividend Tax Rates In 2021 And 2022 The Motley Fool

What Is The Net Investment Income Tax And Who Has To Pay It Bankrate

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

Is An Anomaly In Form 8960 Resulting In An Unintended Tax On Tax Exempt Income

How Long Term Capital Gains Stack On Top Of Ordinary Income Tax Fiphysician

Self Employment Tax Rate Higher Income Investing Freelance Income

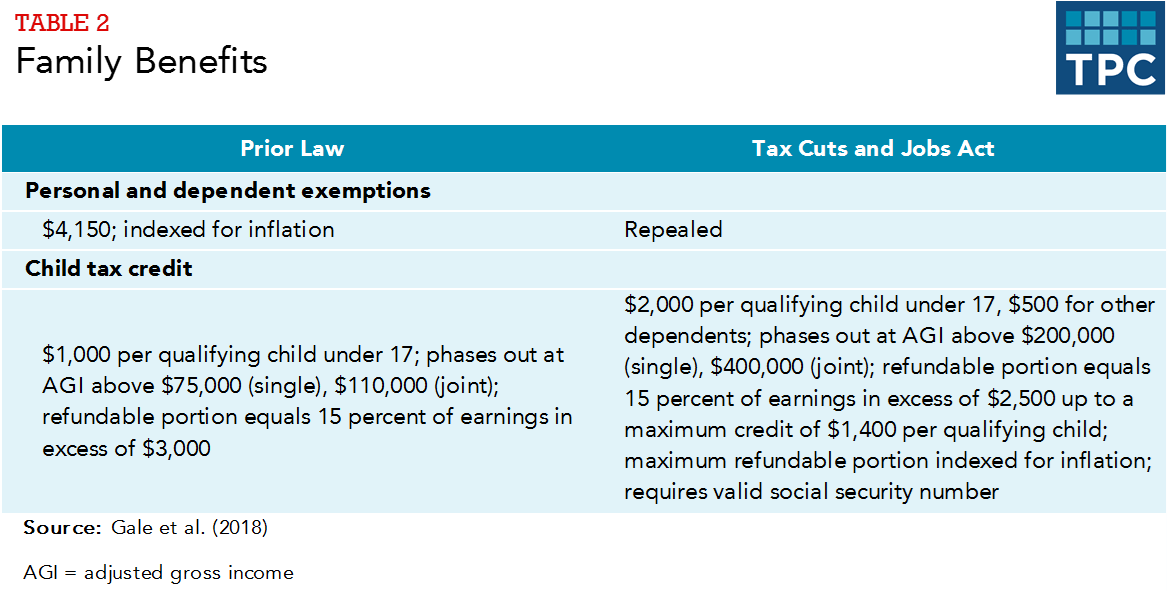

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center