dallas county texas sales tax rate

As for zip codes there are around 138 of them. If you need access to a database of all Texas local sales tax rates visit the sales tax data page.

2021 2022 Tax Information Euless Tx

You can print a 825 sales tax table here.

. The average cumulative sales tax rate between all of them is 825. Sales Tax and Use Tax Rate of Zip Code 75356 is located in Dallas City Dallas County Texas State. Sales Tax and Use Tax Rate of Zip Code 75226 is located in Dallas City Dallas County Texas State.

There is no applicable county tax. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. Texas has a 625 sales tax and Dallas County collects an additional NA so the minimum sales tax rate in Dallas County is 625 not including any city or special district taxes.

The 825 sales tax rate in Dallas consists of 625 Texas state sales tax 1 Dallas tax and 1 Special tax. 3 rows Dallas County TX Sales Tax Rate The current total local sales tax rate in Dallas. Dallas Texas Sales Tax Rate - Learn the total rate of tax you must collect as a business in Collin Denton Kaufman and Rockwall counties - the base rate is 625 in Texas.

Texas has recent rate changes Thu Jul 01 2021. There is no applicable county tax. The Texas state sales tax rate is currently.

How is Sales Tax Calculated in Dallas Texas. The total sales tax rate in any given location can be broken down into state county city and special district rates. Estimated Combined Tax Rate 825 Estimated County Tax Rate 000 Estimated City Tax Rate 100 Estimated Special Tax Rate 100 and Vendor Discount 05 N.

Texas residents 625 percent of sales price less credit for sales or use taxes paid to other states when bringing a motor vehicle into Texas that was purchased in another state. Sales is under Consumption taxes. TX homes for sale dallas County.

A full list of these can be found below. The sales tax rate does not vary. Name Local Code Local Rate TotalRate Name Local Code Local Rate TotalRate.

Dallas TX 75202 Telephone. The base Dallas Texas sales tax rate is 1 and the Dallas Texas sales tax rate Dallas MTA Transit is 1 so when combined with the Texas sales tax rate of. This is the total of state and county sales tax rates.

The Dallas County sales tax rate is. Texas has 2176 cities counties and special districts that collect a local sales tax in addition to the Texas state sales taxClick any locality for a full breakdown of local property taxes or visit our Texas sales tax calculator to lookup local rates by zip code. Dallas County is located in Texas and contains around 21 cities towns and other locations.

The Dallas Texas sales tax is 825 consisting of 625 Texas state sales tax and. 214 653-7888 Se Habla Español. 2 State Sales tax is 625.

The combined sales tax rate for Dallas County TX is 725. The base state sales tax rate in Texas is 625. Automating sales tax compliance can help your business keep compliant with.

2 State Sales tax is 625. Denton county property tax rates 2020. The Texas state sales tax rate is currently.

TX Sales Tax Rate. 33 rows Dallas County Has No County-Level Sales Tax. 625 percent of sales price minus any trade-in allowance.

Local tax rates in Texas range from 0125 to 2 making the sales tax range in Texas 6375 to 825. 811 Owensons Dr Dallas TX 75224 is listed for sale for 299900. AddisonDallas Co 2057217 010000 082500 Allentown 067500 DallasMTA 3057994 010000 AngelinaCo 4003007 005000 AdkinsBexar Co 082500 Alleyton 067500.

The Texas state sales tax rate is currently 625. Dallas County Coronavirus COVID-19 Information. Tax Office Past Tax Rates.

214 653-7811 Fax. TEXAS SALES AND USE TAX RATES April 2022. 27129 Estimated MortgageTax minimize.

While many counties do levy a countywide. Find your Texas combined state and local tax rate. 4 rows Dallas.

This is the total of state county and city sales tax rates. Texas sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Dallas Texas sales tax is a rate of tax a consumer must pay when purchasing goods and some services in Collin Denton Kaufman and Rockwall counties Texas and that a business must collect from their customers.

4104 Shorecrest Dr Dallas TX 75209 is listed for sale for 900000. Sales Tax in Dallas Texas is calculated using the following formula. 214 653-7811 Fax.

Has impacted many state nexus laws and sales tax collection requirements. In Texas 123 counties impose a county sales and use tax for property tax relief. Average Sales Tax With Local.

Texas has 743 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Texas being 625 and the highest Sales Tax rate in Texas at 825. Looking for Dallas County Election Information or Results. To review the rules in Texas visit our state-by-state guide.

The current total local sales tax rate in Dallas TX is. How Does Sales Tax in Dallas compare to the rest of Texas. The 2018 United States Supreme Court decision in South Dakota v.

The most populous location in Dallas County Texas is Dallas. 2022 Tax Rates Estimated 2021 Tax Rates. It is a 018 Acres Lot 1121 SQFT 2 Beds 1 Full Baths in Strickland Acres.

How To File And Pay Sales Tax In Texas Taxvalet

How To Charge Your Customers The Correct Sales Tax Rates

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Tax Rates Richardson Economic Development Partnership

Texas Sales Tax Guide And Calculator 2022 Taxjar

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Tax Information City Of Sachse Official Website

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Texas Sales Tax Guide For Businesses

Texas Sales Tax Small Business Guide Truic

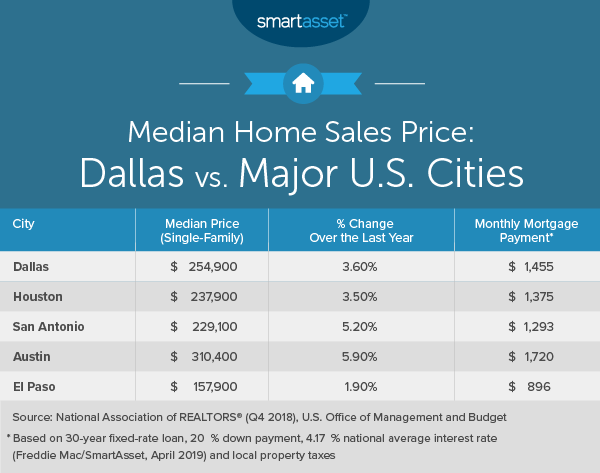

Cost Of Living In Dallas Smartasset

Texas Sales Tax Rates By City County 2022

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

How To Charge Your Customers The Correct Sales Tax Rates

How To Charge Your Customers The Correct Sales Tax Rates

Which Texas Mega City Has Adopted The Highest Property Tax Rate